COMING SOON!

A new Online & Mobile Banking experience.Launching this winter! Offering enhanced security, more timely alerts, and less interruptions to access. Find out more about what to expect during this exciting move.

learn moreThe power to pick.

Kick off your savings goals with a CD Plus account. Choose from two great options: 3.85% APY¹ in 7-months or 3.90% APY¹ in 13-months.

OPEN A CD PLUSAVAILABLE NOW

Investing in a smarter home.You could save with a special rate discount on energy-efficient upgrades. Helping reduce energy costs. With a Green Lending closed-end home equity loan.

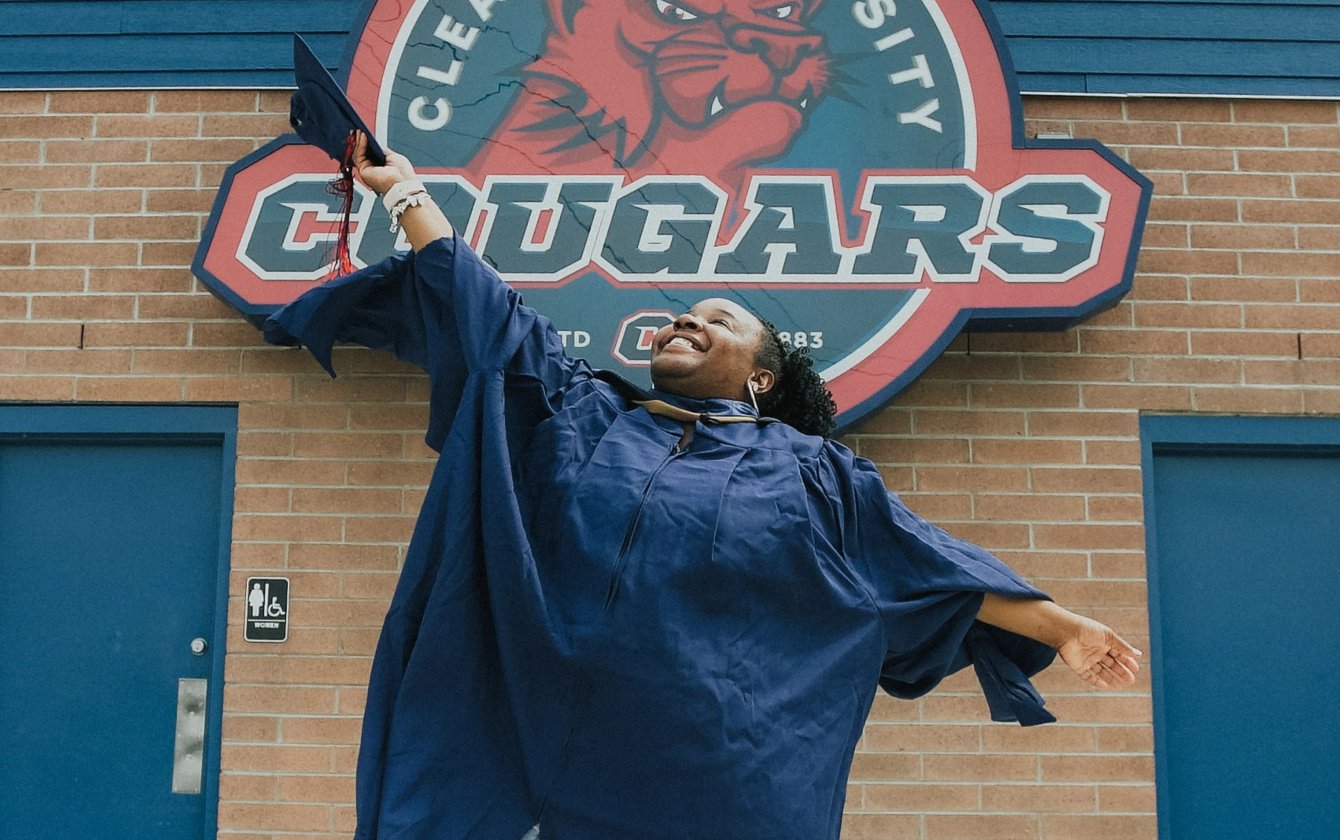

get startedThe power of education.

University and trade school scholarships are now open! Apply today and start toward the career of your dreams.

Learn MoreYour trusted partner for peace of mind.

As a Lake Trust member, you have access to Michigan-based Members Home and Auto® and their team of local insurance professionals. To help you find the best value. And protect your home and auto.

Learn MoreGrowth for your business. And you.

Registration is now open for Lake Trust Entrepreneurship Institute at Cleary University, a free, online course for Michigan small business owners.

SEE PROGRAM DETAILSI’m looking to

Personal Membership

Discover personal banking solutions and empower your path to financial wellbeing.

LEARN MORE

Business Membership

We support Michigan businesses of every size. And we'd love for you to join us. Let's work together.

LEARN MORE

Learn about buying a car.

Visit our Financial Wellbeing Library to learn more about how to prepare to buy a new vehicle.

READ MORE

Find budgeting resources

Plan your budget by using a calculator to estimate the payment on your auto loan.

USE CALCULATOR

Explore financing options.

Shop with a budget in mind and apply for a pre-approval. Or refinance your current auto loan.

VIEW OPTIONS

7 ideas to reach your savings goal.

Reach your next milestone a little faster with these tips to save more each month.

GET SAVINGS TIPS

Plan your next step.

Estimate how your savings will grow over time with the savings goal calculator.

CALCULATE SAVINGS

Watch your savings grow.

Give your savings a boost with a certificate of deposit (CD). Terms available from 3-72 months.

VIEW CD OPTIONS

How to plan your long-term goals.

Setting a goal can help you stay motivated during your financial journey.

SEE PLANNING TIPS

Do you have enough saved to retire?

Use the retirement savings calculator to get an estimate of how long your nest egg will last.

USE CALCULATOR

Empower your future.

Your financial future is in your hands, and our Financial Life Planning team is here to support you.

LET'S PLAN TOGETHER

How to budget to buy a home.

Before you shop for a home, it's a good idea to get a complete picture of your finances.

SEE HOME BUDGETING TIPS

Estimate your monthly payment.

Use a mortgage calculator to see what your monthly payment might look like before you buy a house.

CALCULATE PAYMENT

The power of home.

Your home plays an important role in your life. Find the perfect home loan for your situation.

EXPLORE HOME LOANS

The power of purpose.

Together, we can get one step closer to a world in which everyone thrives.

LEARN ABOUT US

Find your new career.

Explore open positions at Lake Trust in our relationship centers, Contact Center, and our headquarters. Apply online.

EXPLORE POSITIONS

Our story.

We work to create a world in which everyone can explore, discover, and thrive. Learn more about our mission.

SEE OUR STORY

What's on your credit report?

It's a good idea to check your credit report each year. Here's what to look for during your review.

REPORT REVIEW TIPS

Financial moves that impact credit.

Your credit score plays an important role in your financial life. What can you do to change your score?

LEARN ABOUT CREDIT

Learn about credit.

Find articles to learn how your credit score is calculated and what you can expect to find on a credit report.

SEE ARTICLES

Online security tips.

There are simple steps you can take today to keep your online account secure.

SEE TIPS

Your account coverage.

Lake Trust is federally insured by the NCUA. Learn how this coverage applies to your accounts.

COVERAGE LIMIT DETAILS

Online & Mobile Banking.

See recent transaction history and keep track of your accounts by logging in to Online or Mobile Banking regularly.

LEARN HOW

Explore personal loans.

A personal loan is a flexible financing option that can help you consolidate debt or make a large purchase.

SEE PERSONAL LOANS

Business loans.

Start or grow your business with a lending option to fit your needs, whether you need a lot or a little funding.

VIEW BUSINESS LOANS

Financial calculators.

Estimate the payment for your next vehicle or home loan. Or see how long it might take to pay off your credit cards.

USE CALCULATORS

How to conquer your debt.

Reducing or eliminating your debt can have a big impact on your financial wellbeing. See tips to make a plan.

FIND IDEAS

Set a payoff goal.

Create a plan to pay off your credit card debt by using a calculator to estimate how much you should pay each month.

USE CALCULATOR

Explore personal loans.

A personal loan is a flexible financing option that could help you consolidate debt into a more manageable payment.

SEE PERSONAL LOANS

Starting an emergency fund.

Prepare for the obstacles life throws your way with an emergency fund. See how to start yours.

LEARN MORE

Start saving today.

It's a good idea to put your emergency fund in a separate savings account. Open one today in a few quick steps.

OPEN ACCOUNT

Supporting your wellbeing.

Build your emergency fund a little faster in an Aspire Savings. Earn 3.00% APY1 on the first $5,000 in your account.

OPEN ASPIRE SAVINGS

Ideas to save for school.

Take your career to the next step, start a new career, or help your child prepare for college. See tips to manage the cost of school.

READ MORE

Explore what's possible.

Wherever you are on your educational journey, a student loan or refinance can help you cover the cost of school.

STUDENT LOAN OPTIONS

Powerful solutions for school.

Help the future college student in your life. Our Financial Life Planning team can help you create a savings plan.

LEARN MORE

Online & Mobile Banking.

See recent transaction history, transfer funds, make a budget, and more by logging in to Online or Mobile Banking regularly.

LEARN HOW

Visit us.

Find a Lake Trust relationship center, video teller machine, or ATM in your community. Or visit a shared branch.

FIND US

Plan for the future.

Take control of your finances by creating a monthly budget and setting goals for what's next.

SEE BUDGETING IDEAS

Impact takes all of us.

The Lake Trust Foundation enhances wellbeing in Michigan through grants, donations, scholarships, and more.

LEARN MORE

The power of community.

We form partnerships and support organizations that share our dedication to enhancing wellbeing in Michigan.

SEE COMMUNITY IMPACT

View our impact report.

Check out how we work together with our members, team, and partners to make a postive impact across Michigan.

VIEW THE REPORT

Unleash your vision.

A small business microloan can help you take the first step, or the next step, in bringing your business ideas to life.

SEE MICROLOAN OPTIONS

Become a business member.

We support Michigan businesses of every size. And we'd love for you to join us. Let's work together.

VIEW MEMBERSHIP DETAILS

Small business funding.

You have an idea or a vision for your business. Now find the funding support you need with our powerful solutions.

VIEW FUNDING OPTIONS

BUSINESS BANKING

Better for business.

MEMBER SUCCESS STORY

Empowered to dream.

MEMBER SUCCESS STORY

Empowered to dream.

Since childhood, Jennifer R. had a dream to open a clothing boutique. With support from Lake Trust, she brought her dream to life and opened Brass + Oak in Brighton.

read story

1 APY = Annual Percentage Yield. Rates as of February 10, 2026 and are subject to change.

2 Total aggregate balance of micro business loans must be $49,999 or less.

Holiday hours: On Monday, February 16, our branches, Contact Center, and video teller services will be closed in observance of Presidents Day. Online, Mobile, and Text Banking are available 24/7.